Bookkeeping and Payroll Services

We offer virtual bookkeeping and payroll services to Canadian companies looking to get the many benefits of cloud accounting

In online bookkeeping (also called virtual bookkeeping or cloud bookkeeping), you and your bookkeeper use cloud-accounting and document management software to create a secure, paperless system. This allows you to exchange receipts and business documents and to collaborate and get financial statements without having to exchange any paper documents.

Benefits Of Virtual Bookkeeping And Payroll

There are many benefits to using virtual bookkeeping and payroll services. Here are the main ones:

More current books

It leads to your books being more up-to-date on a regular basis because your bookkeeper will always have access to the statements and receipts they need for their work. They won't be as reliant on you to find and send them receipts. (There are still some receipts you'll have to photograph on your mobile with an app, or manually upload, but it's a big reduction.)

Timely and accurate profit and loss statements

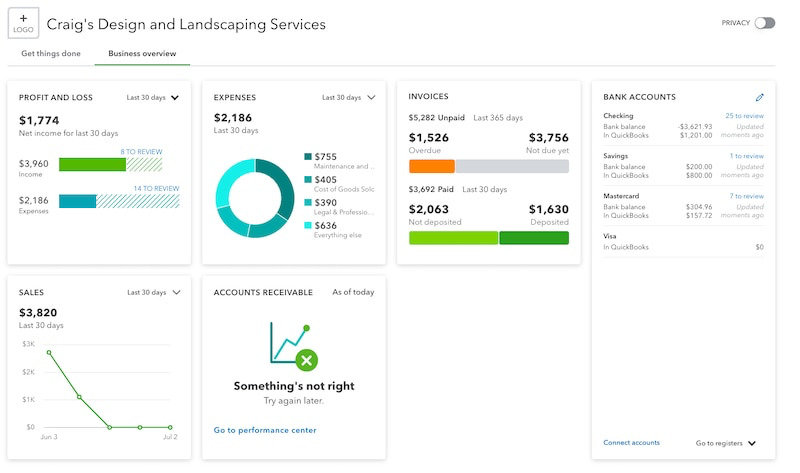

Virtual bookkeeping allows you to keep a better handle on your expenses and profitability and to make changes throughout the year to affect them. With most virtual bookkeeping systems, you have access to your books via the web or a mobile app which provides much greater transparency and insight into the business versus traditional bookkeeping. With traditional bookkeeping, you might not see a profit and loss statement until your year-end. With virtual bookkeeping, it is quite easy to provide monthly profit and loss statements at minimal extra cost.

Reduced bookkeeping time and errors

Using a virtual bookkeeping system saves a significant amount of data-entry time and decreases the number of mistakes that come from inaccurately keying in the data. This means you'll most likely reduce your bookkeeping costs because it will take less time to do your books each month. We cut our first client's bookkeeping costs in half.

Archiving and compliance

It also provides a very convenient archive of all your paper receipts so that if you ever need to look up a receipt, you can find it in seconds, rather than pulling out boxes from several years ago and trying to wade through piles of paper.

More options & reduced costs

Virtual bookkeeping allows us to find the best bookkeepers in Canada at reasonable hourly rates. We are no longer restricted to working only with bookkeepers who are in our immediate vicinity. This allows us to offer excellent bookkeeping services to you at competitive rates. We have been able to lower the overall cost of bookkeeping for many of our clients.

Bookkeeping and Payroll Services We Offer

Accounting system management & reporting

We input all your revenue and expenses into an accounting system and categorize receipts so that you can pull reports that provide you insight on your income, spending and profitability.

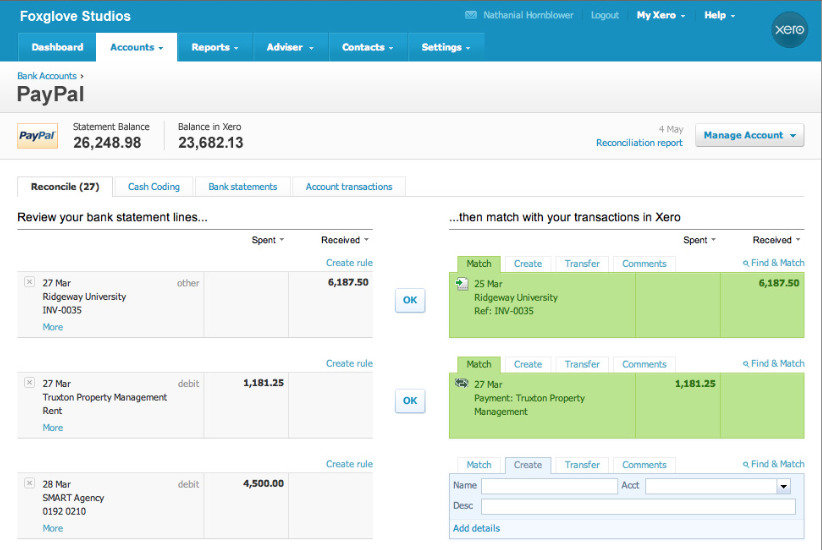

Account reconciliation

We reconcile your bank and credit card statements against your individual receipts and invoices to ensure accuracy and completeness.

Expense and revenue management

We organize and categorize your business receipts and invoices.

Accounts receivable / Accounts payable

We can manage your accounts receivables (generating invoices, managing reminders and payments) and your payables (the payment of your bills using an online service like Plooto).

Sales and payroll taxes

We can calculate and file your sales taxes and payroll taxes (including HST/GST, EHT and WSIB). We do not file T2 corporate tax returns.

Year-end

We prepare a year-end reporting package for your accountant to be able to do an efficient year-end.

Payroll

We provide complete payroll support and handle all your government payroll remittances. We can:

- Setup your staff or contractors in the payroll system

- Make sure everyone gets paid the right amount on time each month

- Manage salaried, hourly or commission-based staff or contractors

- Help you implement digital time tracking systems

- Do holiday pay calculations

- Do your government remittance reporting & filing

- Manage your compliance obligations

- Reconcile your payroll

Our Approach

You'll be assigned a dedicated bookkeeper who you'll be able to access on the schedule you agree on.

You can email your bookkeeper at any time. For meetings and calls, we recommend setting up specific times.

Dext and Hubdoc are more secure compared to email, so they are the primary way you will exchange documents with your bookkeeper. They extract data from receipts and organize it for faster processing into the accounting software. Dext has built-in contextual messaging so our bookkeepers can ask you for clarifications about receipts, without cluttering up your email.

In terms of cloud accounting systems, we only use Xero and Quickbooks Online and we are experts in both systems and integrating them with other third-party systems.

We use bookkeeping management software called Financial Cents to manage our workflow and reminders. It has a slick feature that enables us to send you a list of items we need and it reminds you until you check them all off. Our clients love how it puts all the requests in one list for them.

Easy Onboarding

- We will ensure you start off using our services as quickly as possible.

- We begin with a virtual meeting on Zoom.

- After asking you about your current bookkeeping setup, we develop a system which is optimal, cost-effective and uniquely suited to your needs.

- You’ll have to provide us with information and perform some setup tasks. We’ll take care of the whole process.

For more details please see What To Expect As A New Client Of Back Office Stars – Our Onboarding Process

Sectors We Service

We specialize in serving the following sectors and types of business:

Marketing & Tech-Related Businesses

- Digital agencies

- Web design & development agencies

- SEO, SEM, PPC agencies

- Marketing, PR, promotion agencies

- Marketing consultants and strategists

- Tech companies

- Software companies

Professional Services, Consulting & Health

- Recruiters

- Consultants

- Lawyers

- Engineers

- Insurance Brokers

- Wealth Managers

- Chiropractors

- Massage Therapists

Trades & Service Companies

- Maintenance & Cleaning

- Hazard Removal

- Landscaping & Snow Removal

- HVAC

- Roofing

- Plumbing

- Electrical

- Painting

How To Handle Payroll For Small Business In Canada In 2025 – Step By Step Guide

This step by step guide will show you how to handle payroll for small business in Canada in 2025. Written for Canadian entrepreneurs. Updated Jan 2025.

Frequently asked questions

Here are some of the most frequent questions we get from our customers.

You can have a look at our sample packages here. We charge $55/hour for bookkeeping services and $70/hr for time-sensitive accounts payable or payroll services. We are very efficient and have found that we frequently complete the same work another bookkeeper previously did in substantially less time. The cost of software like Xero, Quickbooks Online or Hubdoc are incremental to that. You’ll also be responsible for any transaction fees incurred from payroll or bill payment services that charge on a transaction basis.

You’ll be asked to provide in-depth information on what services you’d like to include in your plan. You can either submit a form giving us the information such as the # of accounts and transactions or we can go over it together in a call. We usually respond within 48 hours of receiving your form submission.

Our team members are all based in Canada (Ontario, Alberta, and BC).

Yes, for sure. You can contact your bookkeeper at any time via email and you can set up times to meet at your convenience.

All our lead bookkeepers have a college diploma in bookkeeping and at least ten years of bookkeeping experience. If junior bookkeepers work on your file, they are always supervised by a senior bookkeeper, a team leader and an oversight accountant.

Yes, we calculate these taxes for our clients and then file the tax returns for them.

No, we are not able to pay these taxes for you, but we can calculate them for you and remind you for the payment.

No, but we can connect you with some accounting firms which can prepare these taxes for you.

Yes, we manage payroll for many clients. WagePoint, Knit People and Quickbooks Payroll are our favourite payroll apps. We can enter the payroll hours, or you can add them yourself. These apps will pay your salaries and submit the T4s and Records Of Employment to the CRA automatically.

We won’t be responsible for late payments which may be due to circumstances beyond our control.

Absolutely! Plooto is our top choice for a bill payment application, perfectly integrating with QuickBooks Online and Xero. If you manage more than six invoices that need manual payments, Plooto can help you save both time and money compared to traditional methods like cheques or e-transfers. It enables us to manage the specifics of payments—such as the payee, the amount, and the timing—while you retain complete control over your finances.

Unfortunately, we only work with businesses that are registered in Canada.