Ecommerce Bookkeeping Services

Welcome to our top-tier e-commerce bookkeeping services, where we seamlessly blend expert financial management with the convenience of virtual support for businesses across Canada.

Specializing in the latest cloud accounting software such as Dext Commerce, A2X, Xero, QuickBooks Online, Dext Prepare, and Hubdoc, we ensure that your e-commerce business stays ahead of the curve.

Trust us to be your partner in bookkeeping, supporting you at every step and simplifying your financial processes with our cutting-edge, cloud-based solutions.

E-commerce Bookkeeping Services We Offer

Integration Setup & Optimization

We optimize the integrations between your e-commerce system, payment processors and your accounting system so that you can pull timely, accurate reports that provide you insight on your sales, spending and profitability.

Expense and revenue management

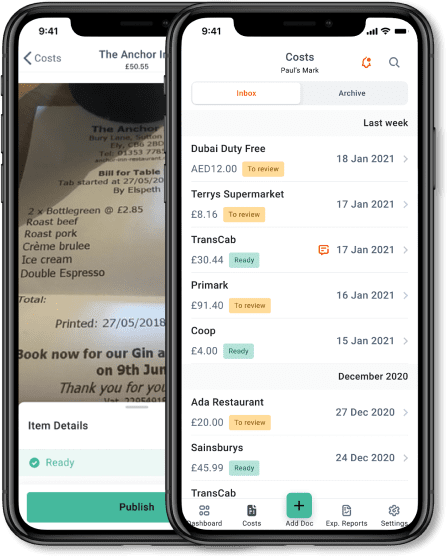

We organize and categorize all your business expense receipts and your sales invoices. We make sure you claim all applicable sales tax credits.

Reconciliations

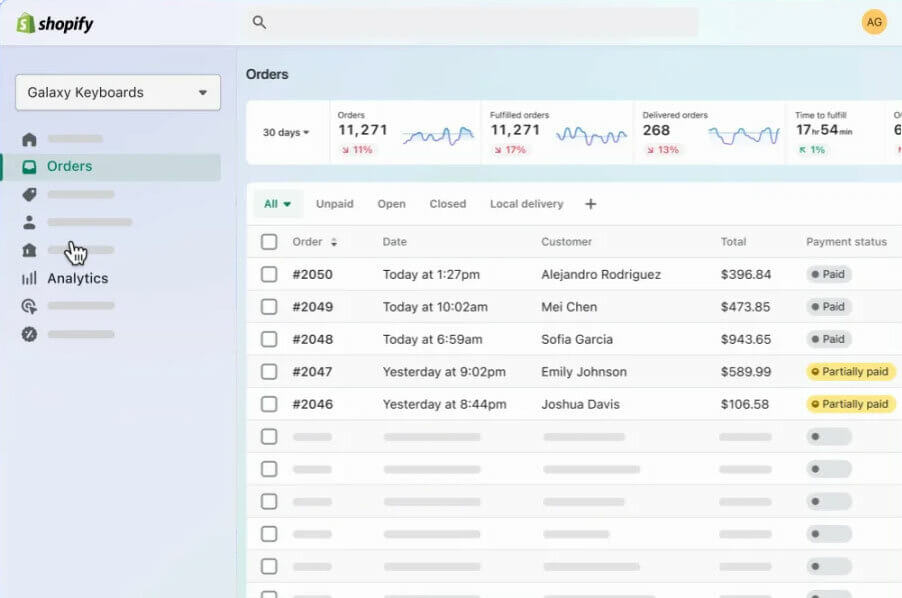

We reconcile your bank statements and credit card statements against the data in the accounting system and reports from payment processors like Stripe, Moneris, Paypal, or Shopify to ensure accuracy and completeness.

Accounts payable

We can help you manage paying contractors and supplier invoices using services like Wise or Plooto.

Year-End

We prepare all the documentation for your accountant to be able to do an efficient and painless year-end.

Taxes

We can calculate and file your business and payroll taxes (including HST/GST, EHT and WSIB).

Payroll

We can manage your payroll and government payroll remittances.

How Our Ecommerce Bookkeeping Services Work

You'll be working with a dedicated e-commerce bookkeeper located in Canada. You'll be able to contact them on a schedule that you agree on.

Correspondence between you and the bookkeeper will be primarily done via email, but you can also arrange to set up calls or web meetings.

Dext is the preferred way for you and your bookkeeper to share the documents. Dext serves as the central database for the bookkeeping process. Dext has built-in contextual messaging so our bookkeepers can ask you for clarifications about receipts, without cluttering up your email.

In terms of cloud accounting systems, we only use Xero and Quickbooks Online and we are experts in both systems and integrating them with other third-party systems like Dext Commerce or A2X.

We use bookkeeping management software called Financial Cents to manage our workflow and reminders and it has an excellent feature that enables us to send you a list of documents we need and it reminds you until you check them all off. Our clients love how it puts all the requests in one list for them.

Simple Onboarding

- We help you get set up with virtual bookkeeping quickly.

- We start with a virtual kickoff meeting using Zoom, a web-based conferencing tool.

- We ask you about your existing systems and how you do your bookkeeping, and then we develop an approach that delivers the right solution for your needs while keeping efficiency and cost in mind.

- There are some setup tasks you need to complete (mostly providing information to us), and then we try to take care of the rest.

For more details please see What To Expect As A New Client Of Back Office Stars – Our Onboarding Process

Fast, Accurate, and Reliable Service

Our Canadian team is committed to providing fast and precise bookkeeping services, ensuring your financial data is always up-to-date and dependable.

Supportive Partnership Every Step of the Way

We're not just a service provider; we're your partner in growth. Our team is here to support you at every step, from setting up your bookkeeping system to ongoing financial management. We'll guide you through the complexities of e-commerce finances, ensuring you have a clear understanding and control over your business's financial trajectory.

More Information

Sectors We Service

We focus on serving the following sectors and types of business:

Ecommerce & Tech

- E-commerce (Shopify, WooCommerce, Amazon, Etsy, Stripe)

- Tech & software

- Web design & development agencies

- SEO, SEM, PPC agencies

- Online Training, Virtual Events

Professional Services

- Financial Advisors

- Recruiters

- Consultants

- Lawyers

- Insurance

- Real-Estate Agents

Health Clinics and Non-Profits

- Chiropractors

- Massage Therapists

- Occupational Therapists

- Physiotherapists

- Gyms

- Non-profits and charities

Frequently asked questions

Here are some of the most frequent questions we get from potential clients.

We have experience using Shopify, WooCommerce, Magento, Amazon, Etsy, Stripe, Square, PayPal, Moneris and many other e-commerce related systems. We also have experience using A2X and Dext Commerce.

We have some example pricing packages here. We charge $55/hour for bookkeeping services and $70/hr for time-sensitive accounts payable and payroll services. We are very efficient and have found that we often complete the same work another bookkeeper previously did in less time. The cost of software like Xero, Quickbooks Online, Dext/Hubdoc, A2X/Dext Commerce are incremental to that. You’ll also be responsible for any transaction fees incurred from payroll or bill payment services that charge on a transaction basis.

You’ll be asked to provide in-depth information on what services you’d like to include in your plan. You can either submit a form giving us the information such as the # of accounts and transactions or we can go over it together in a call. We usually respond within 48 hours of receiving your form submission.

All our team members are based in Canada (Ontario, Alberta and BC).

You can email your bookkeeper at any time, and they’ll respond within a few hours.

You can also set up a phone call or a virtual meeting by emailing them first.

All our lead bookkeepers have a college diploma in bookkeeping and at least ten years of bookkeeping experience. If junior bookkeepers work on your file, they are always supervised by a senior bookkeeper, a team leader and an oversight accountant.

Common challenges include managing and accurately categorizing a high-volume of transactions, sales tax compliance, inventory tracking, and integrating various sales channels and payment gateways into your accounting system. We can help you deal with all these issues proactively.

Accurate bookkeeping ensures that you report the correct income and expenses for tax purposes. It helps in claiming all eligible deductions and avoiding CRA penalties for underreporting income.

Yes, of course. We calculate and file the taxes for you.

We will not PAY your taxes on your behalf. However, we can calculate these taxes, but you’ll have to pay them yourself.

No, we can’t file these tax returns for you. You’ll need an accounting firm for that and we can help you find a good one if you don’t already have one.

Yes, we use several services including WagePoint, Knit People and Quickbooks Payroll to manage your payroll. You can enter the payroll hours. The software will pay your remittances automatically. T4s and ROE will automatically be submitted to the CRA.

Yes. Plooto is our favourite bill payment app, and it integrates well with QuickBooks Online and Xero. If you receive more than half a dozen invoices that need manual payments, Plooto can save you time and money compared to checks or e-transfers. It allows you to delegate the details of who to pay, how much, and when to us while keeping financial control over your payments.

We generally don't do bookkeeping for non-Canadian firms. We do serve Canadian clients with US entities.