Small Business Bookkeeping

In online bookkeeping (also called virtual bookkeeping or cloud bookkeeping), you and your bookkeeper use cloud-accounting and document management software to create a secure, paperless system. This allows you to exchange receipts and business documents and to collaborate and get financial statements without having to exchange any paper documents.

Small Business Bookkeeping Services We Offer

Expense and revenue management

Organizing your business expense receipts and invoices.

Accounting system management (journal entries) & reporting

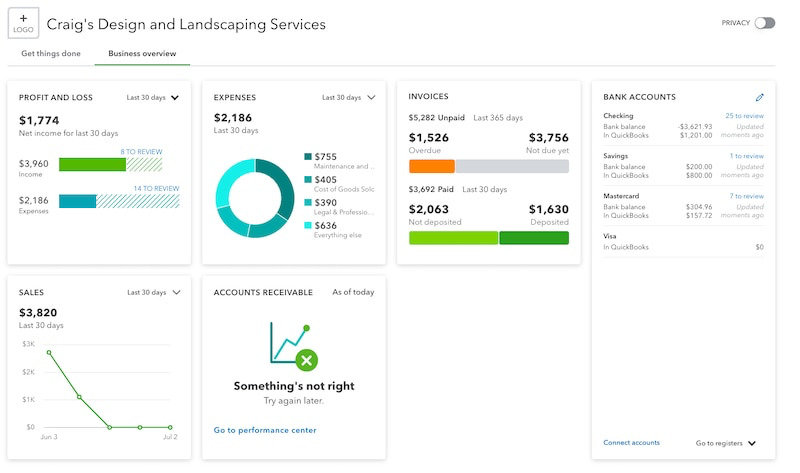

Inputting all your revenue and expenses into the accounting system as individual entries and categorizing them so that you can pull reports. These reports will give insight on your income, expenses and profitability.

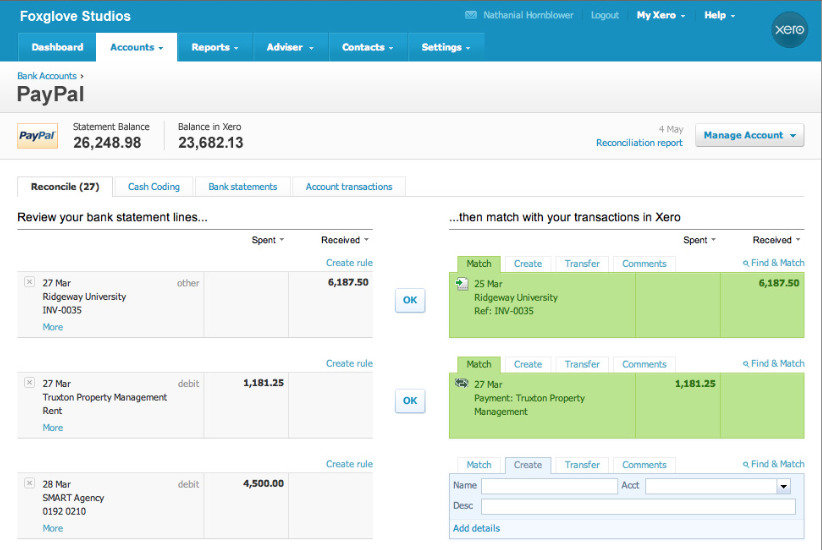

Reconciliations

Reconciling bank statements and credit card statements against your invoices and expense receipts to ensure completeness and accuracy.

Year-End

Preparing a year end package for your accountant to enable them to perform an efficient and painless year-end.

Payroll

Managing your payroll payments and government payroll remittances.

Accounts receivable / Accounts payable

Managing your receivables (generating invoices, managing reminders and receiving payments) and your payables such as bill payments via an online service like Plooto.

Taxes

Calculation and filing of your business and payroll taxes (including EHT, HST/PST/GST and WSIB).

How We Work With You

A dedicated bookkeeper will be assigned to you. You will work with them on an ongoing basis and have access to them during the days and hours you agree during onboarding.

You can correspond with your bookkeeper via email at any time.

You can set up specific times for phone or web-based meetings.

You share all documents with your bookkeeper via Dext because it’s more secure than email and it is the central database of all input files for the bookkeeping process.

In terms of cloud accounting systems, we only use Quickbooks Online and Xero and we are experts in both systems and integrating them with other third-party systems.

We use bookkeeping management software called Financial Cents to manage our workflow and reminders and it has a feature that enables us to send you a list of items we need and it reminds you until you check them all off. Our clients love how it puts all the requests in one list for them.

Simple Onboarding

- We help you get setup and running with virtual bookkeeping quickly.

- We start with a virtual kickoff meeting using a virtual conferencing tool like Zoom.

- We will ask you about your current system and how you manage your bookkeeping and then we develop an approach that is optimized for your needs while keeping efficiency and cost in mind.

- There are a few setup tasks you need to complete (mostly providing information to us) and then we try to take care of the rest.

For more details please see What To Expect As A New Client Of Back Office Stars – Our Onboarding Process

More Information

Sectors We Service

We focus on serving the following sectors and types of business:

Marketing and Tech-Related Businesses

- Web design and development agencies

- Digital agencies

- SEM, SEO, PPC agencies

- Marketing consultants and strategists

- Marketing, PR, promotion agencies

- Tech startups and tech firms

Professional Services, Consulting & Health

- Wealth Management

- Consultants

- Recruiters

- Lawyers

- Engineering Consulting

- Insurance

- Chiropractors

- Massage Therapists

Trades & Service Companies

- Landscaping & Snow Removal

- Maintenance & Cleaning

- HVAC

- Roofing

- Plumbing

- Electrical

- Hazard Removal

- Painting

Fill out the form below to book a call with us for a no-obligation chat about your bookkeeping needs.

Frequently asked questions

Here are some of the most frequent questions we get from our customer.

You can review sample virtual bookkeeping packages here. Our packages are built around a $55/hr rate for bookkeeper time and $70/hr for time-sensitive accounts payable and payroll services, plus the cost of all the software (Hubdoc, Xero, etc.). Any per transaction costs like those charged by bill payment services (Plooto) are paid directly by you.

To give you an accurate quote, we need to ask you which specific services you want, the volume of accounts and transactions you have each month. We will ask you to fill out a form to give us this information and then we can give you an accurate estimate of your monthly bookkeeping cost. We can generally provide a quote within 48 hours of receiving your form submission.

All our team members are based in Canada (Ontario, BC, Alberta and PEI).

Yes, absolutely. You can email your bookkeeper at any time, and he/she will generally respond within a few hours on a weekday.

You can also set up a specific time for a phone or web-based meeting.

All our bookkeepers have at least 5 years of bookkeeping experience before coming to us. Most of our team have 10-15 years of bookkeeping experience.

Yes, we can. We can calculate and file these tax returns for you.

No. We will calculate the payments, inform you and remind you, but you are responsible for all payments to the CRA.

No, we do not prepare tax returns, and we cannot file your corporate or personal taxes for you. However, we work closely with several accounting firms and would be glad to introduce you to them so you can find the best fit for you.

Yes, we can. We use Quickbooks Payroll and WagePoint to manage payroll for you. You, the client, enter the payroll hours, or you send them to us, and we enter them for you. They will file and pay your remittances automatically. It will auto-populate T4s and Records Of Employment (ROE) and submit them to the CRA. The key feature that differentiates it from Payment Evolution (its main competitor) is that it does holiday pay calculations for you. Employee pay stubs are accessible online.

We are not responsible for the wrath of your employees or contractors for late payments that result from circumstances beyond our control including insufficient funds in your bank accounts or failure on your part to approve transactions in time.

Yes, we can. Our preferred approach is to use Plooto, a bill payment app that integrates well with Xero. Your bills go into Hubdoc, then get transferred to your accounting software which pushes the payment to Plooto, and then Plooto returns a confirmation to your accounting software. Plooto costs $0.50 per transaction and payments arrive at the recipient within 3-4 days unless you prepay Plooto in advance. We are not responsible for penalties you incur for late payments that result from circumstances beyond our control including insufficient funds in your bank accounts or failure on your part to approve transactions in time.

If your business is registered or incorporated outside of Canada then, no, we would not take you on as a client.

If your business is registered or incorporated in Canada, but you live outside of Canada or are traveling, then we would take on your business.