Construction Bookkeeping Services

At Back Office Stars, we specialize in providing bookkeeping solutions tailored specifically for the construction industry and general contractors. Our expertise ensures that your financial records remain accurate, compliant, and optimized for your unique business needs.

Specializing in the latest cloud accounting software such as Xero, QuickBooks Online, Hubdoc and Dext, we ensure that your business uses the most efficient systems to deliver accurate project and cost management.

With extensive experience supporting Canadian general contractors and trades, we understand your operational challenges and financial objectives. Our team is dedicated to helping you manage your complex projects with confidence and achieve your financial goals.

Why Choose Us for Your Construction Bookkeeping?

Specialized Construction Bookkeeping Expertise

We understand the complexities of construction accounting, including job costing, revenue recognition, and the completed contract method. Our team is experienced in managing direct and indirect costs, retainage tracking, and percentage-of-completion accounting methods, ensuring that your financial records reflect the true profitability of each project.

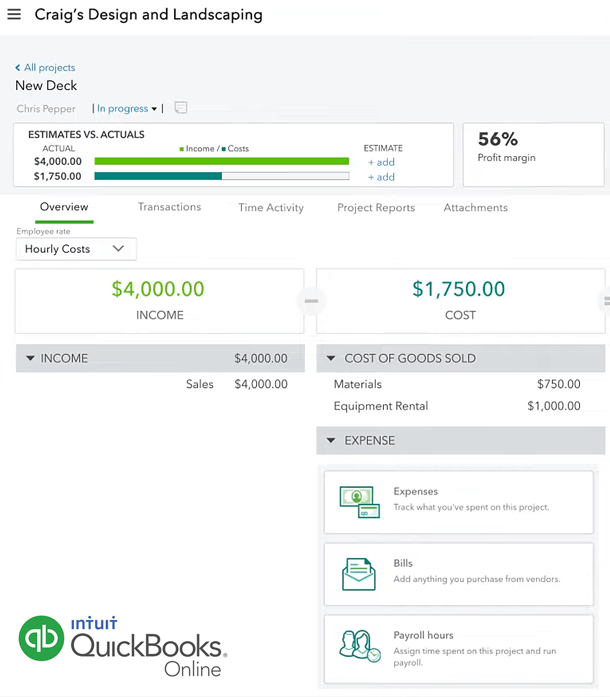

Project-Based Financial Tracking

Our bookkeeping services are designed to track project costs, including materials, labor, and overhead expenses, with precision. We help you use industry-leading tools and software to manage multiple projects simultaneously, helping you stay organized and on budget.

Cash Flow Management

Managing cash flow effectively is critical in the construction industry. We optimize your cash flow by monitoring payments, and ensuring that invoicing and collections are handled in a timely manner. Our proactive approach helps you maintain financial stability and avoid cash shortfalls.

Payroll and Compliance Services

We provide comprehensive payroll management for both employees and subcontractors. Our services include tax compliance with CRA and provincial regulations, ensuring that your business meets all required reporting and remittance obligations. Additionally, we can apply billable hours to projects, allowing for accurate tracking and allocation of labor costs.

Cloud-Based and Virtual Solutions

Our virtual bookkeeping services offer the convenience of secure, cloud-based platforms, allowing you to access financial records anytime, from anywhere. With real-time financial insights, you can make informed business decisions without being tied to a physical office.

Accurate Financial Reporting

We deliver detailed financial reports, including balance sheets, income statements, cash flow statements, and profitability analyses. These insights provide a clear financial picture, enabling better decision-making and strategic planning for your construction business. Additionally, we can provide details on project budgets and financials, ensuring you have full visibility into costs, revenues, and overall project profitability.

Automation and Software Integration

We leverage advanced bookkeeping software such as QuickBooks Online, Xero, and Dext to automate processes, reduce manual errors, and improve efficiency. Our integrations streamline financial management, saving you time and effort.

Customizable Services

We offer flexible bookkeeping packages tailored to the size and budget of small construction firms. Whether you need full-service bookkeeping and payroll or specific support, our customizable solutions allow you to add or remove services as needed, ensuring you receive exactly what your business requires.

How Our Construction Bookkeeping Services Work

When you choose our services, you'll be paired with a dedicated bookkeeper based in Canada. You can communicate with your bookkeeper on a mutually agreed-upon schedule.

Most of your correspondence will take place via email, but you're welcome to arrange calls or web meetings as needed.

We prefer using Dext for sharing documents, which serves as a central database for our bookkeeping process.

In terms of cloud accounting systems, we only use Xero and Quickbooks Online.

We manage our workflow and reminders through bookkeeping management software called Financial Cents. This software includes an excellent feature that allows us to send you a list of required documents and it reminds you until you check them all off. Our clients appreciate having all requests organized in one list.

A Smooth Start

- We streamline the setup process for your virtual bookkeeping. It begins with a virtual kickoff meeting on Zoom.

- During this meeting, we'll discuss your existing systems and bookkeeping practices to devise an approach tailored to your needs while prioritizing efficiency and cost-effectiveness.

- There are some setup tasks you will need to complete, mainly providing us with necessary information, after which we will handle the rest.

For more details please see What To Expect As A New Client Of Back Office Stars – Our Onboarding Process

Efficient, Accurate, and Dependable

Our Canadian team is dedicated to delivering fast and precise bookkeeping services, ensuring that your financial data is always up-to-date and dependable.

Comprehensive Support for Lasting Growth

We view ourselves as more than just a service provider; we are your partners in growth. Our team is here to support you throughout the entire process, from establishing your bookkeeping system to ongoing financial management. We will guide you through the complexities of construction project cost management, ensuring you have a clear understanding and control over your business’s financial health.

Frequently Asked Questions

Here are some of the most frequent questions we get from potential construction and contracting clients.

We provide bank reconciliations, payroll, payables, receivables and sales tax management, job costing, revenue recognition, progress billing, financial reporting, compliance assistance, and more.

Yes, we specialize in tracking project revenue and costs for individual construction projects and providing accurate reporting. Each project is assigned a job number, and all related costs (materials, labor, equipment, subcontractors) are tracked separately. This approach provides detailed cost visibility, allowing you to monitor profitability on a per-project basis.

Yes. We help you invoice clients based on completed work milestones and ensure that you get paid at the various stages of the project while complying with provincial laws.

Yes. We will help you accurately separate Direct Costs (expenses directly attributable to a project) like materials, labor, subcontractors from Indirect Costs or Overhead Costs shared across multiple projects like insurance, office rent, admin salaries). Proper allocation ensures accurate job costing and financial reporting.

We exclusively work with QuickBooks Online and Xero, customizing them to meet your specific needs.

We charge $55/hour for general bookkeeping services and $70/hr for time-sensitive accounts payable and payroll services.

We charge a base fee that starts at $80/mo for clients with 4 or less hours/mo and scales up at roughly $18 per hour of services per month. As an example, the base fee for a 10 hour/mo client is $170/mo.

We are very efficient and have found that we often complete the same work another bookkeeper previously did in less time. The cost of software like Xero, Quickbooks Online, Dext/Hubdoc are incremental to that. You’ll also be responsible for any transaction fees incurred from payroll or bill payment services that charge on a transaction basis.

You’ll be asked to provide in-depth information on what services you’d like to include in your plan. You can either submit a form giving us the information such as the # of accounts and transactions or we can go over it together in a call. We usually respond within 48 hours of receiving your form submission.

All our team members are based in Canada (BC, Alberta and Ontario).

You can email your bookkeeper at any time, and they’ll respond within a few hours.

You can also set up a phone call or a virtual meeting by emailing them first.

All our lead bookkeepers have a college diploma in bookkeeping and at least ten years of bookkeeping experience. If junior bookkeepers work on your file, they are always supervised by a senior bookkeeper, a team leader and an oversight accountant.

Yes, of course. We calculate and file the taxes for you.

We will not PAY your taxes on your behalf. However, we can calculate these taxes, but you’ll have to pay them yourself.

No, we can’t file these tax returns for you. You’ll need an accounting firm for that and we can help you find a good one if you don’t already have one.

Yes, we use several services including WagePoint, Knit People and Quickbooks Payroll to manage your payroll. You can enter the payroll hours. The software will pay your remittances automatically. T4s and ROE will automatically be submitted to the CRA.

However, we aren’t responsible for late payments which might occur because of insufficient funds in your account or you not approving the transactions on time.

Definitely! Plooto stands out as our preferred choice for a bill payment app, seamlessly integrating with QuickBooks Online and Xero. For those handling over six invoices requiring manual payments, Plooto offers significant savings in both time and expense compared to conventional methods like checks or e-transfers. It allows us to manage various payment details—such as the recipient, the amount, and the timing—while you maintain full control over your finances.