Apr 20, 2022

How to save HubDoc app password in iOS for autofill

This video shows you how to save your HubDoc app password into your iPhone's autofill so that you can easily access the app to scan…

Written by Jonathan

Aug 18, 2023 Under 3min read

Yes. If you hire and pay employees, setting up a CRA Payroll Account is mandatory. What if you hire employees before setting up the account?

You’ll still have to set it up as soon as possible and remit deductions by the due date. Otherwise, you’ll face penalties.

First off, check if you have already registered for the account. It’s possible you already registered when you signed up to receive your business number.

Otherwise, you can set up a CRA Payroll Account in two ways: over the phone or online.

Before you sign up, ensure you have the following information:

Say your pay period is two weeks, and your employee only works for five days. To prorate their salary, you’ll have to determine their daily rate. Assuming your employees only work Monday to Friday, you can take their salary and divide it by 260.

For example:

Salary: $60,000

Daily Rate: 60,000/ 260

= $230.77

5-day pay: 5 ($230.77)

= $1,153.85

According to the CRA, all businesses must make a reasonable effort to obtain employee SINs within three days of their hire date. If you don’t, you’ll face a penalty. However, an employee without a SIN isn’t an excuse to avoid remitting deductions. You’ll still have to file a T4 information return.

Yes, all businesses must pay CPP contributions and EI premiums for every employee. Additionally, you must deduct CPP and EI from employee wages and remit them to the CRA.

However, a few exemptions apply. Family members working for your corporation might not be considered as having insurable employment, thus exempting them from EI premiums. Indigenous employees are exempt from CPP contributions.

The CRA charges the following penalties for late remittance reports:

Your first step in determining tax amounts is to obtain employee Federal and Provincial TD1 forms. Check Line 13 to find the tax exemption amount.

No. Indigenous employees have exemptions that distinguish them from regular employees. Refer to the CRA’s website for more information.

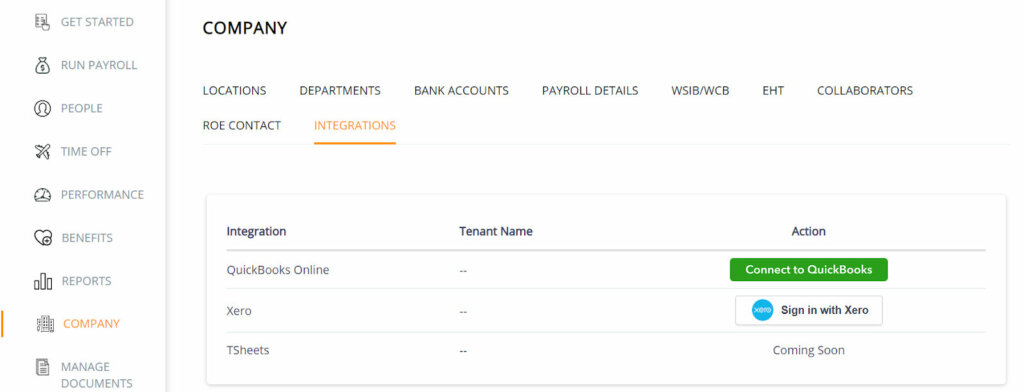

You don’t have to, but it would certainly make things easier. Both Wagepoint and Knit have an integration service where you can integrate data from Quickbooks, Xero and other accounting software:

At first glance, keeping payroll internal might feel more affordable. But that’s not always the case, especially if you’re a relatively new business. You might not have the budget to hire an in-house bookkeeper. OK, so why not manage it yourself? Unless you have the expertise, you’ll need to carve out valuable time to manage payroll properly. Mistakes will be costly.

Here are a few benefits of outsourcing payroll management services:

Chapters

Apr 20, 2022

This video shows you how to save your HubDoc app password into your iPhone's autofill so that you can easily access the app to scan…

Jun 15, 2022

You already work with remote designers and developers and manage them using cloud apps like Slack, Asana, G-Suite, Zoom, Loom, InVision,…

Apr 9, 2022

Do you need to manage recurring tasks as part of a workflow for your team? Asana is a great, free, way to do this. In this 1 min office…