2 weeks ago

Why a virtual bookkeeping service is perfect for tech entrepreneurs & startups

You already work with remote designers and developers and manage them using cloud apps like Slack, Asana, G-Suite, Zoom, Loom, Upwork, and…

Written by Jonathan

Nov 1, 2024 Under 7min read

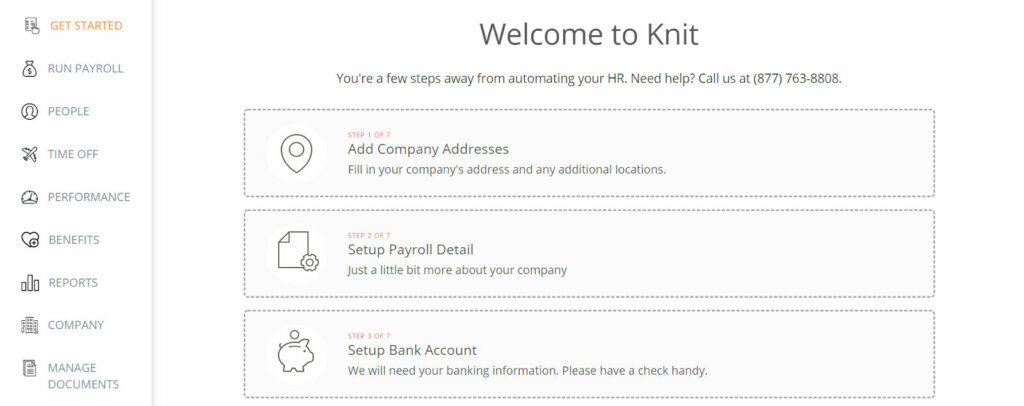

In this set of step-by-step instructions, we’ll cover how you set up payroll in Knit People.

First, you’ll add some company details like your primary address and other locations.

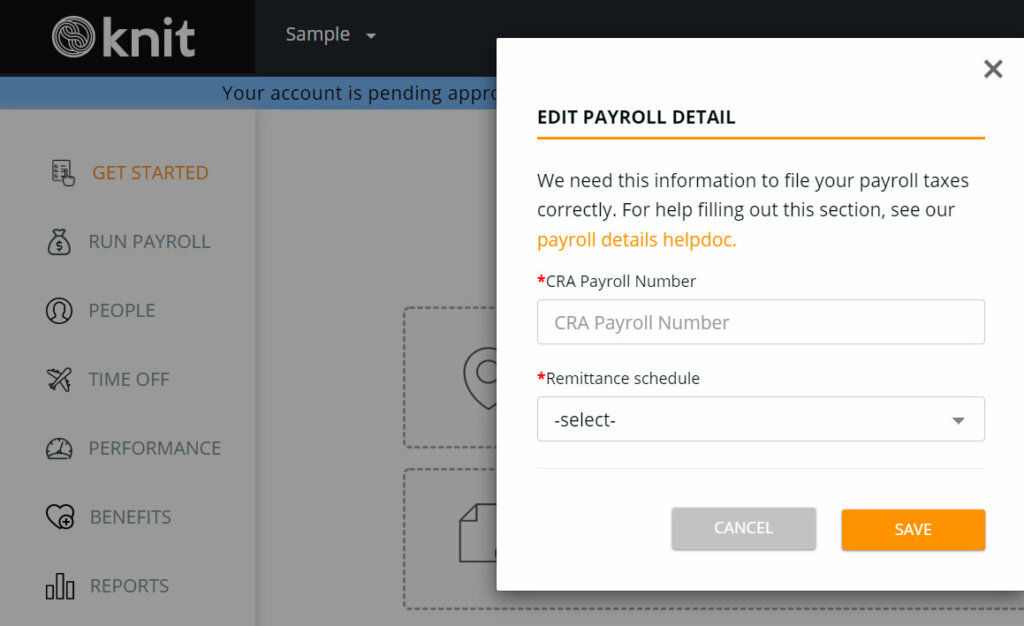

Next, you’ll need your CRA payroll number.

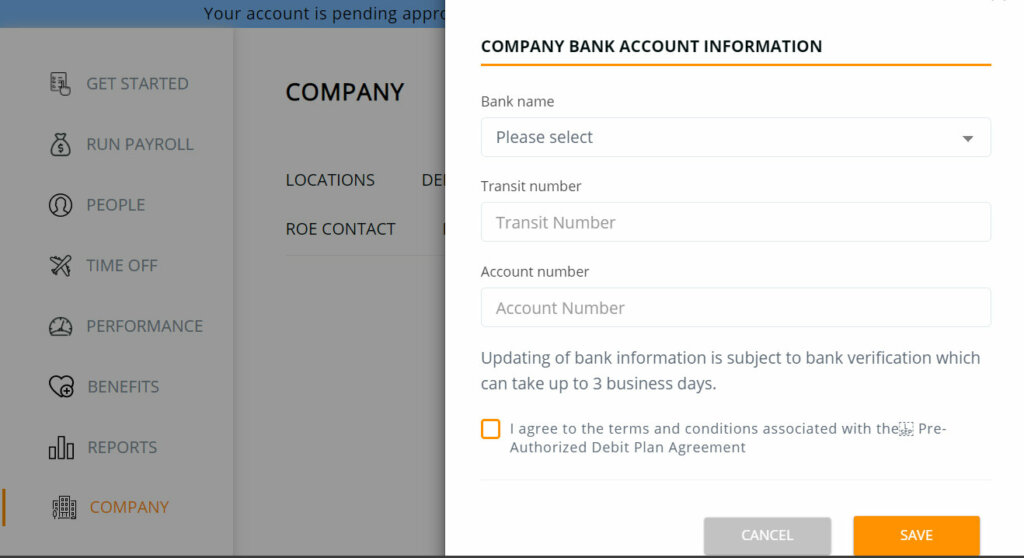

After that, you can set up your bank account information. Keep in mind that this is a mandatory step to use Knit’s software. Without it, you can’t run payroll.

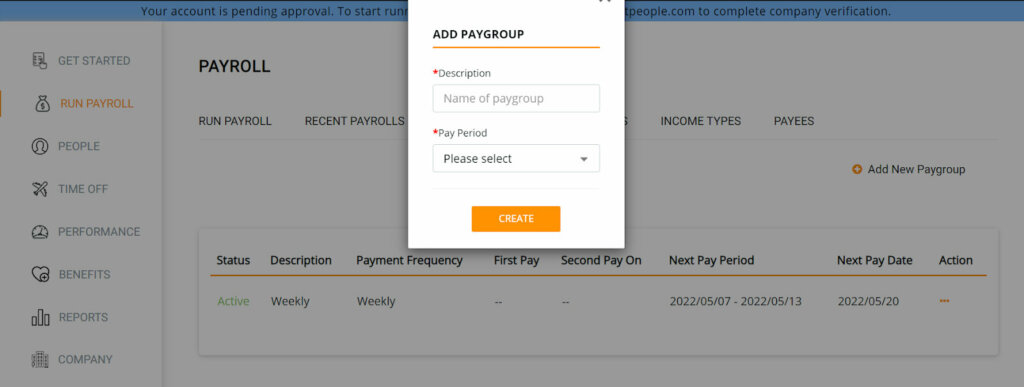

Next up, your employees need some attention. But first, it’s time to create a paygroup.

Do you pay employees weekly? Monthly? Quarterly?

Keep a solid record so you can keep your payroll schedule regular. Knit has a place for you to add paygroups before jumping into employee information.

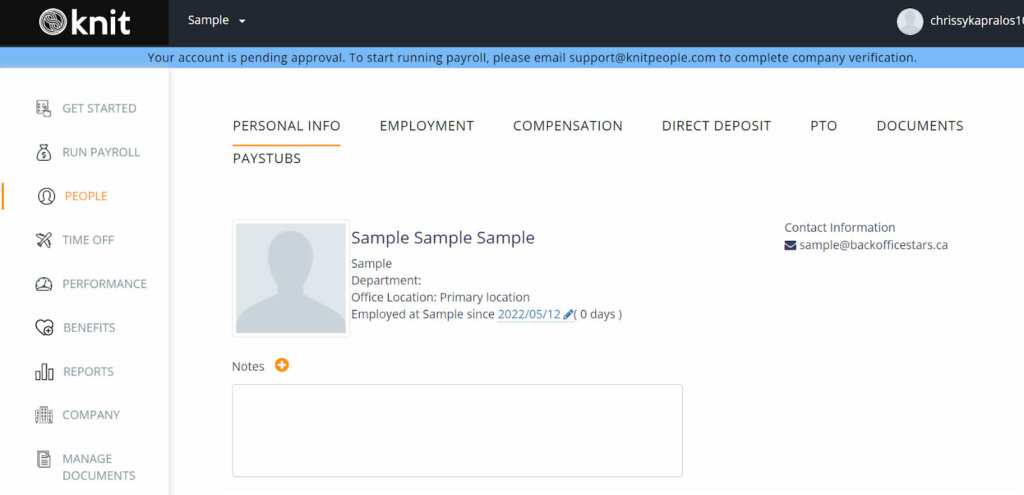

When managing payroll for small business in Canada, you’ll need to have employee information handy. Luckily, Knit keeps everything organized and secure, perfect for sensitive employee information.

Here’s what you need for each employee:

Pro tip: Knit lets employees onboard themselves. All you need to do is add them as collaborators.

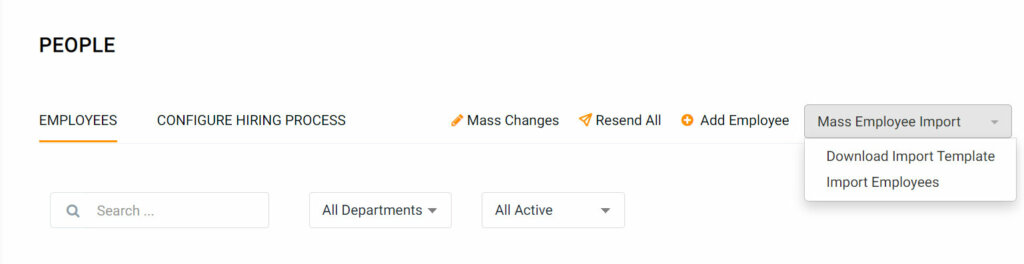

Note the multiple tabs for employment information, personal info, direct deposit, compensation, etc. You can click each tab to input relevant employee info. Alternatively, you might decide to import employee info with a template.

Here’s the downloadable template we like to use! Once you fill it out and submit it through the software, Knit auto-populates all employee fields.

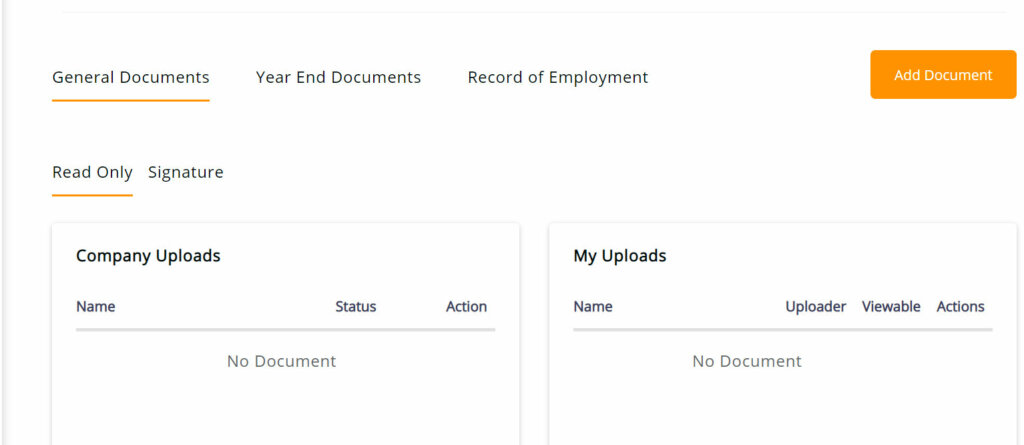

You’ll also want to maintain meticulous records (or face the consequences, more on those later). On Knit, you have a “documents” tab for every employee where you can save pretty much anything you want, including employment agreements.

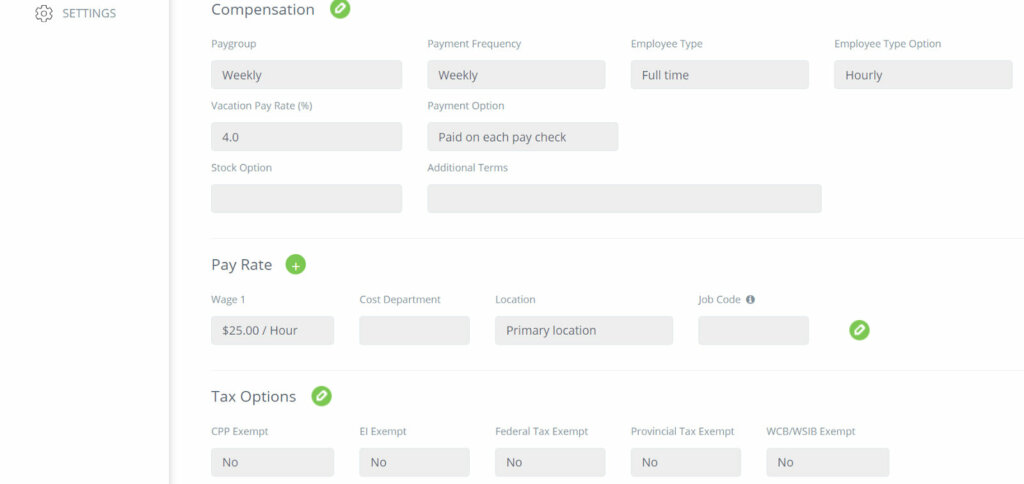

Next up: compensation.

How much do you pay your employees before deductions?

Gross wages refer to the dollar amount you promise to pay your employees on their employment agreements – hourly rate, annual salary, etc. On top of that, gross wages include reimbursements and allowances, like gym memberships, cell phone plans, transportation costs, etc.

Say your employee makes an annual salary of $75,000, paid biweekly. You also pay them $50 every two weeks for a gym membership reimbursement.

So, your employee’s gross wages are $3,175 every pay period (biweekly).

Knit makes it easy to record gross wages with the employee compensation tab:

Gross wages don’t account for deductions like CPP, EI, disability, benefits, and others. So, you’ll have to consider those when running payroll.

If you ever worked a salaried job, you might remember your employer withholding deductions. It showed up as removed from gross wages on your paystub, and you’d receive a T4 at the end of the year.

Now, it’s your turn to manage those deductions! To start, you’ll need to withhold and pay the CRA the following deductions:

What’s attractive about payroll software like Knit is that it deducts mandatory CRA amounts automatically. You just plug in your compensation information, and everything’s taken care of.

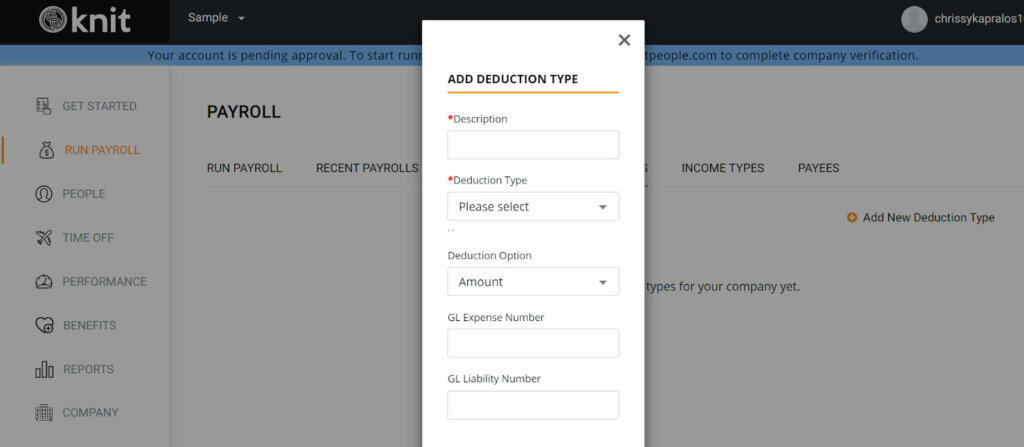

However, you might consider adding other deductions that could apply to your employees. Knit offers you the option to deduct or contribute:

You also have the option to customize deductions with “Other,” “Voluntary,” or “General” categories.

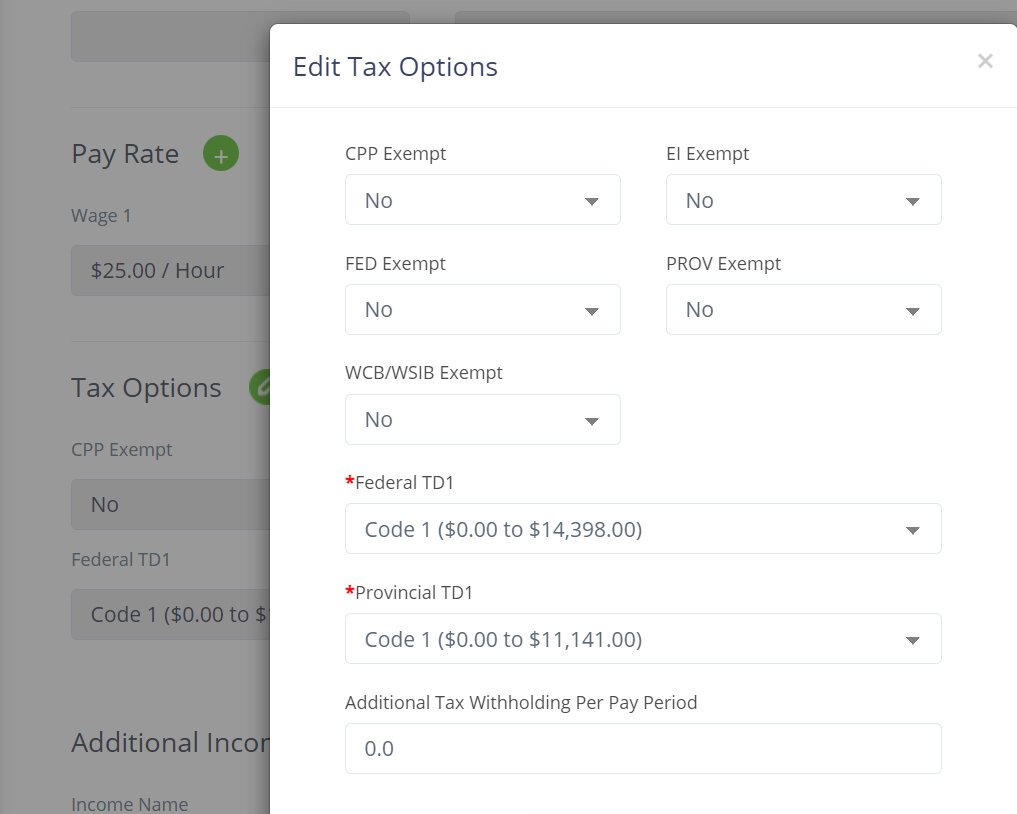

Like all things, exemptions apply. You might have an employee exempt from certain tax deductions or employment insurance. It’s essential to consider those before you run payroll.

Knit allows you to customize exemptions on employee pages in the “compensation” tab.

For example, family members might not be eligible for employment insurance, and therefore you wouldn’t apply those deductions to them. Likewise, Indigenous employees don’t have to contribute to CPP.

You can pay your employees once you figure out gross wages minus applicable taxes and deductions.

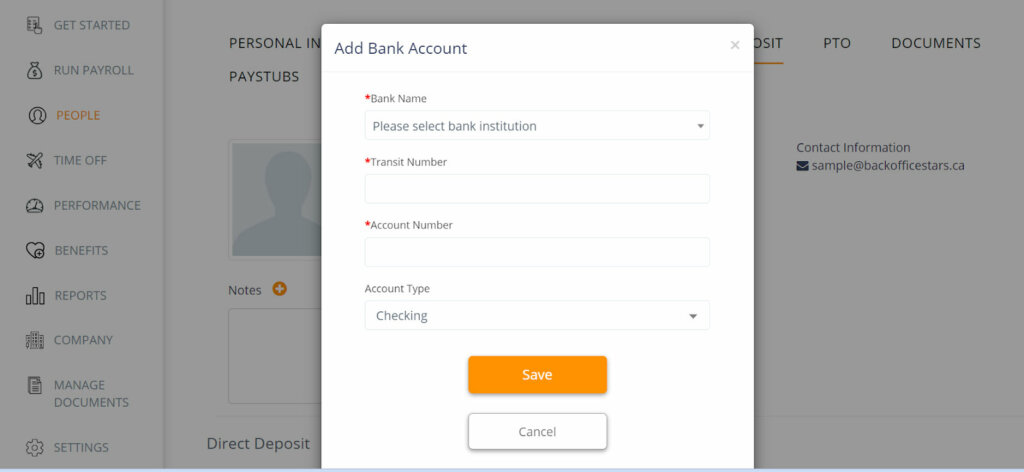

Some businesses keep it old school and mail a cheque. But if you’re living in 2022, you’ll likely use direct deposit.

Knit lets you input direct deposit information for every employee and run payroll on scheduled dates:

Remember all those deductions you made for CPP, EI, and taxes? Your next step in the payroll process is to pay them to the CRA by the due date — or face penalties. You’ll usually be able to pay through a few avenues, including a mailed cheque or bank transfer.

As for frequency: you can pay the CRA every week, second week, or quarter.

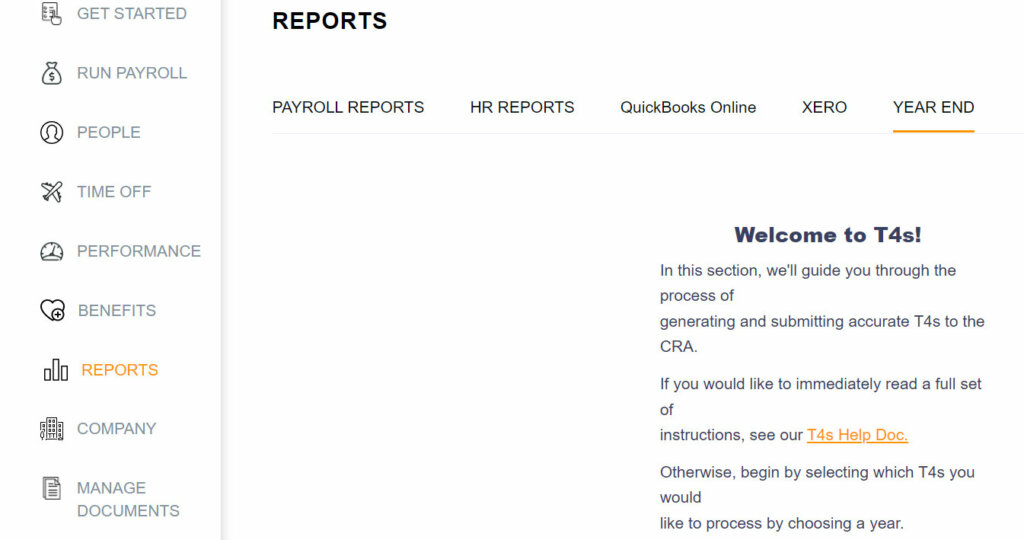

You’ve reached the final step of the payroll process! Still with us? Let’s finish up with T4s. As you know, every employee you pay needs a T4 form.

Knit lets you manage T4 slips through the “Year End Reports” section:

Once you run the reports, employees can log in and view them on Knit. Remember, employees must be able to access T4s by February 28th for the previous year’s taxes.

When an employee leaves your firm, you are required to file a record of employment with Service Canada within 5 days of their last day of work.

The most convenient way to do this is to sign up for ROE Web, a government web service that allows you to generate ROE’s yourself. They do have to verify your identity and that can take a week so don’t wait to register for this. Sign up for it now now and you’ll have access when you need it.

You can also call Service Canada and request paper forms.

Your payroll software should contain a template to use to fill out the ROE online. You must complete block 15C and provide up to 53 weeks of payroll data including the gross wages per period and total insurable hours.(less if they were employed for under a year). The reason for leaving must also be indicated on the form (IE: termination, shortage of work, resignation)

Failing to file and ROE can lead to Federal fines up to $2000.00, and could also result in a judgment against the employer for damages to an employee for the inconvenience of having EI or other benefits held back while waiting for an ROE.

Chapters

2 weeks ago

You already work with remote designers and developers and manage them using cloud apps like Slack, Asana, G-Suite, Zoom, Loom, Upwork, and…

2 weeks ago

Do you need to manage recurring tasks as part of a workflow for your team? Asana is a great, free, way to do this. In this 1 min office…

Jan 23, 2025

Endless instructions and considerations make payroll services in Canada a pain. That’s why we put together this guide on how to set up…