2 weeks ago

Why a virtual bookkeeping service is perfect for tech entrepreneurs & startups

You already work with remote designers and developers and manage them using cloud apps like Slack, Asana, G-Suite, Zoom, Loom, Upwork, and…

Written by Jonathan

Aug 19, 2022 ~6min read

Before you can run your payroll in Wagepoint, you’ll have to complete a few steps.

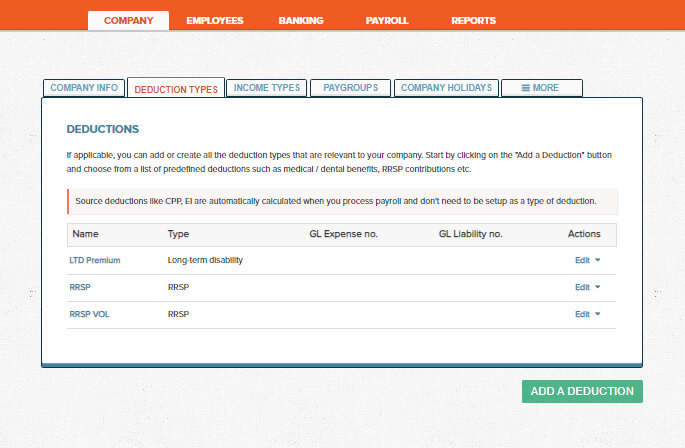

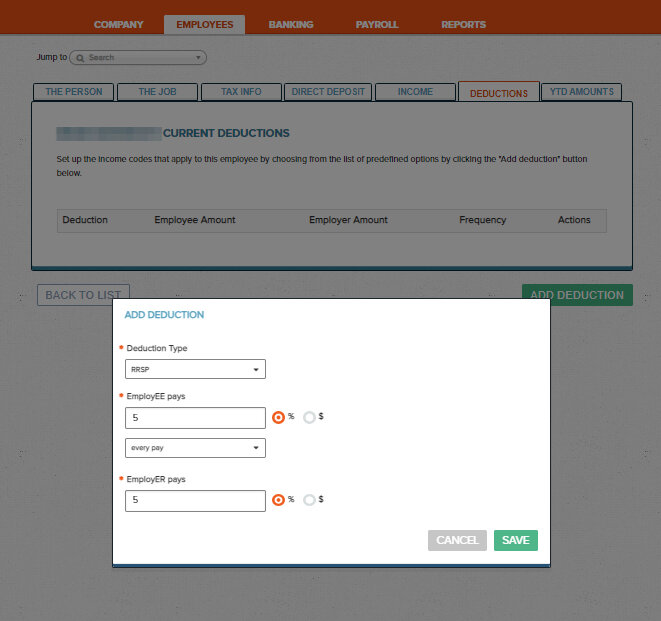

Next, you’ll setup deduction types for deductions outside of normal payroll deductions (EI, CPP, Tax)

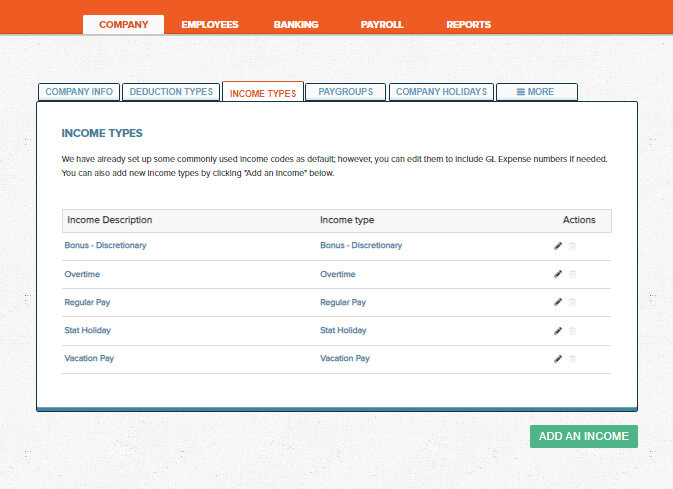

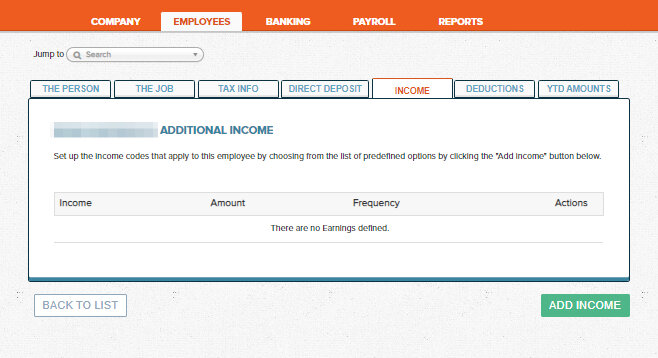

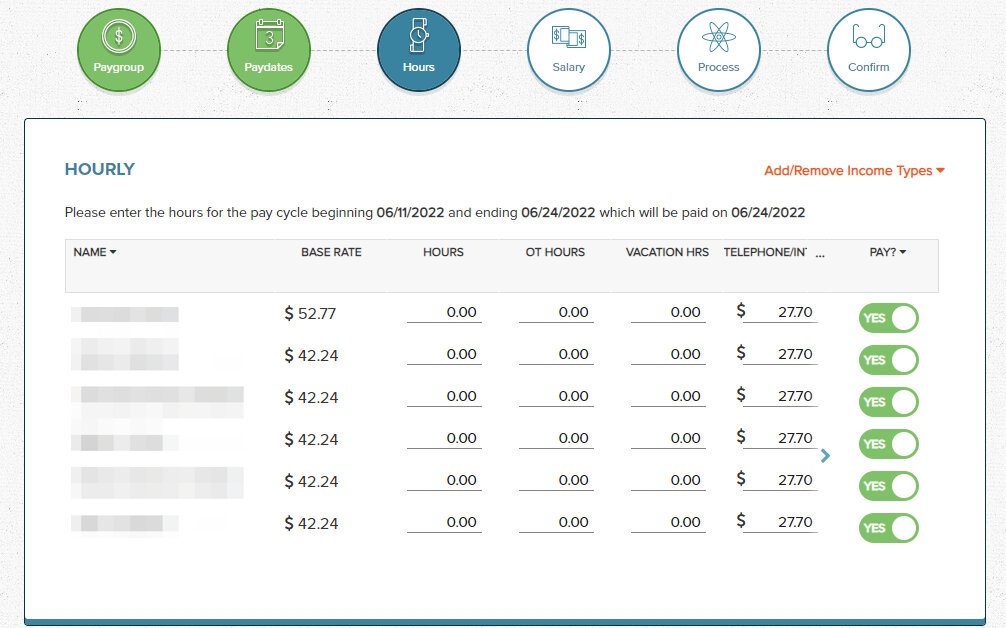

You may have different departments, bonuses, overtime or service wages, here is where you can define them.

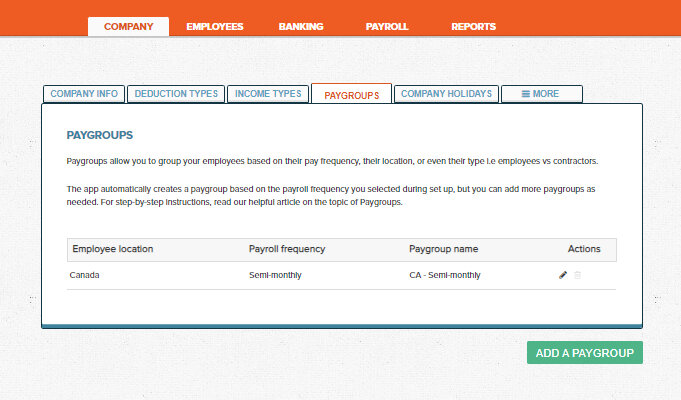

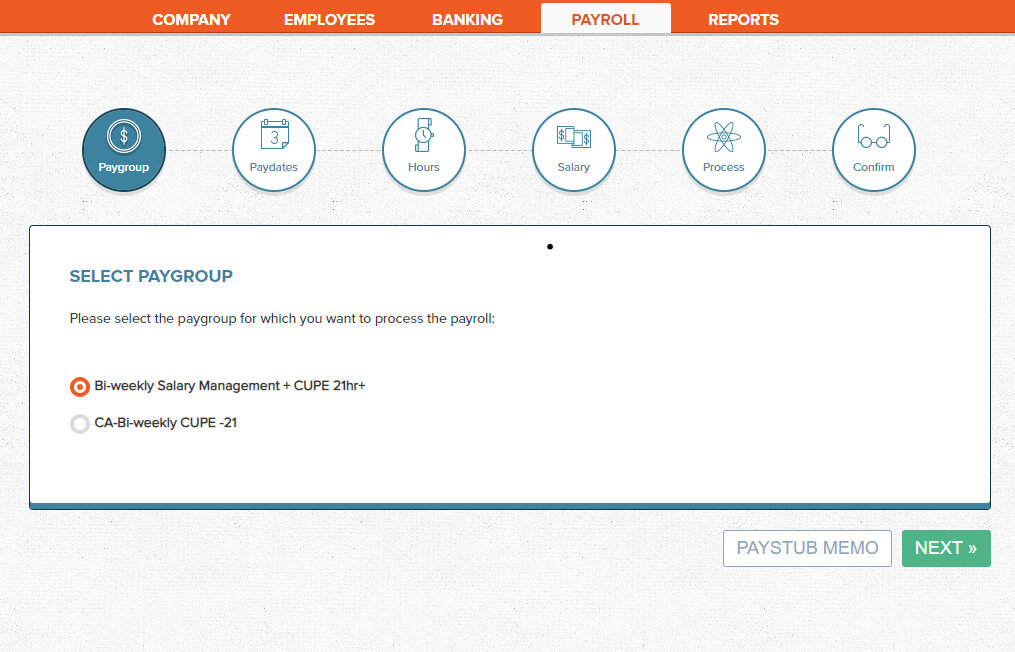

In this section you can add one, or multiple pay groups, for example: Salaried Employees, Hourly Employees, Bi-Weekly, Semi-Monthly, Union employees etc. Depending on your payroll needs, this feature can be useful when doing payroll for large companies with more than the basic one pay-run.

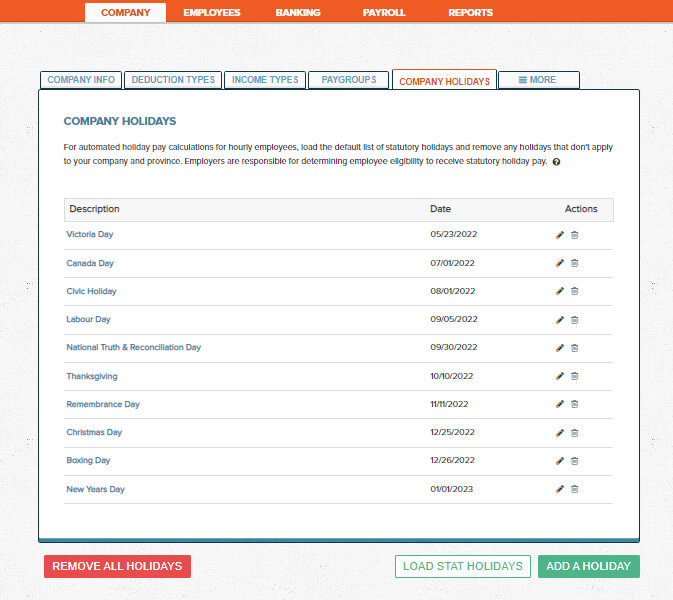

In this section, you can add/remove holidays that apply to your company and region. Wagepoint will automatically calculate stat pay for these days, saving you time and ensuring none are missed or miss-calculated.

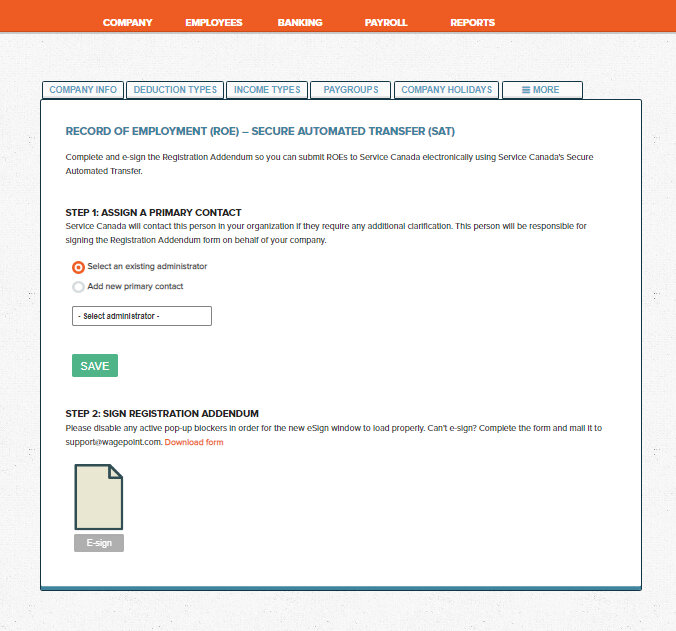

Wagepoint will generate and submit ROE’s to Service Canada for you when an employee is terminated or laid off in the system. In the section below ( found under “More”) you can add the primary contact for ROEs, by selecting an existing administrator or adding a new one. After e-signing the registration, filing ROE’s manually will be a thing of the past.

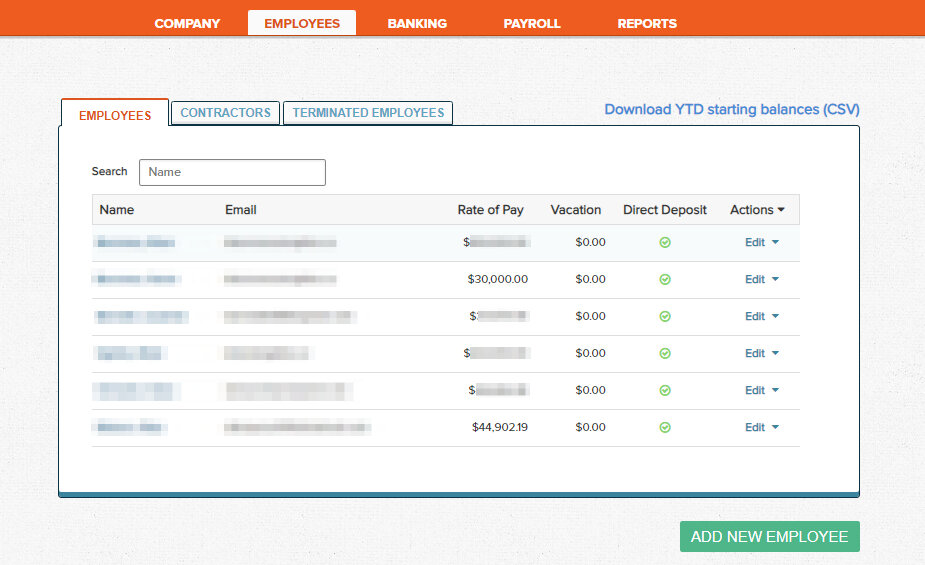

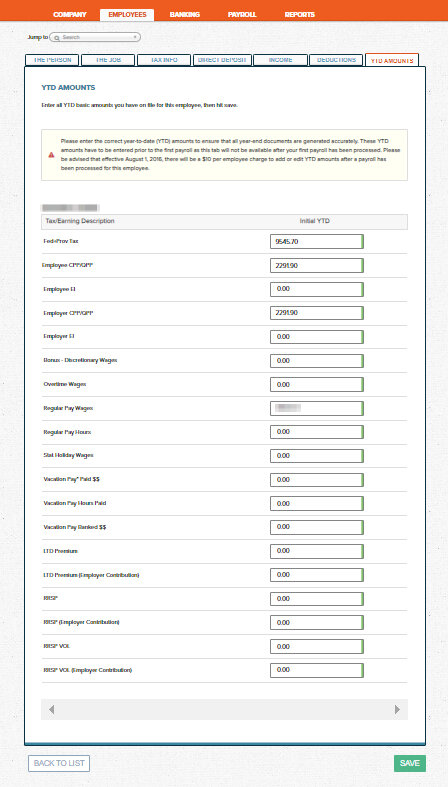

By clicking on the “employees tab” you can add you employees, their information, and income and deduction types. Before running your first payroll, you will need to add any year to date amounts paid, as well as all deductions and company contributions, these amounts will be accounted for on the T4’s.

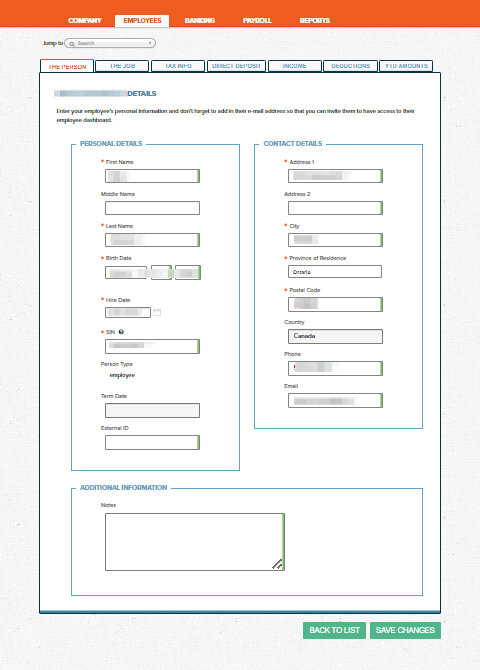

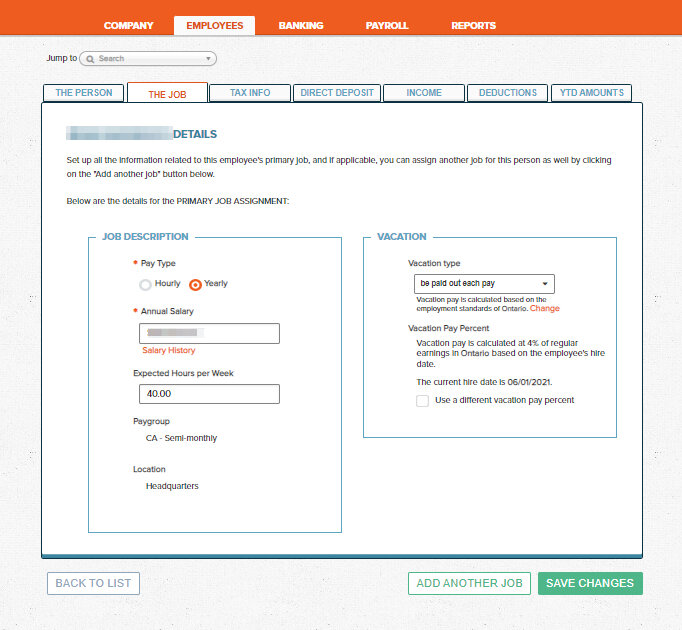

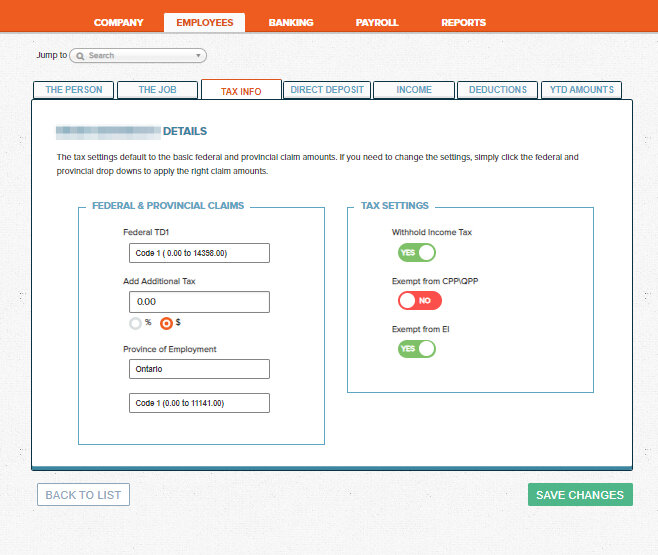

Once you’ve added an employee, you can go through the easy to navigate tabs and fill out all the pertinent information, contact details, direct deposit information, income and deductions.

Add the details:

In the example below this person is a business owner so it’s permissible to exempt them from EI and even CPP if they so choose.

If the person is not a shareholder or is not a close relative of the owner then you cannot exempt them from CPP or EI.

For more information on EI for close relatives of the business owners, look up “Not dealing at arm’s length for purposes of the Employment Insurance Act (EIA)”

Here is the CRA article on EI and CPP.

If you are setting up a new employee mid-way through the year and in their previous employment they maxed out their EI or CPP, do not mark them as exempt. Instead, input their year-to-date amounts and Wagepoint will figure out that no further deductions are required for the rest of the year, but importantly, it will restart them on Jan 1.

* Just a note, when you switch payroll service providers, they should provide you with ROES so all insurable pay period information is captured, and you should ensure they do not file year-end reports on your behalf.

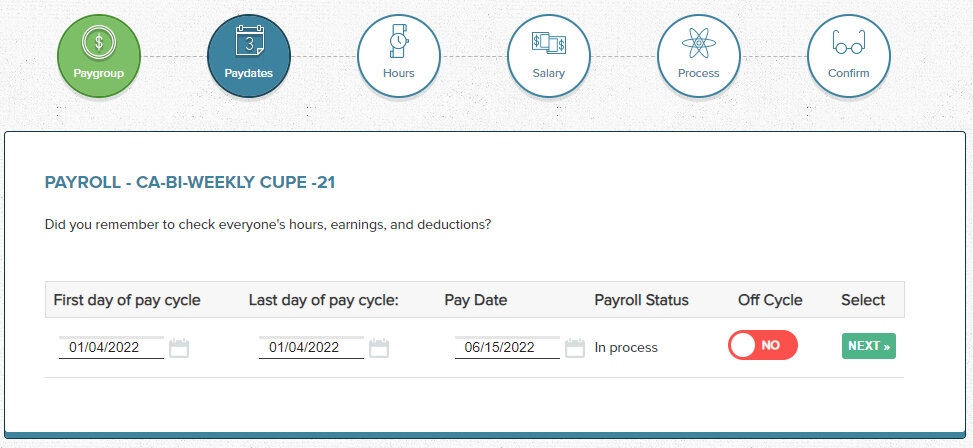

Now that everything is set up, you can run the payroll! Payroll must be processed 3 full business days prior to pay day by noon. There is also an option to automatically process payroll for salaried employees, if you want to do less input. Note: you will need to ensure any changes are made 3 business days before payroll is to be received by your employees.

To run your payroll go to “Payroll” select the pay group, enter your hours and any additional deductions for the period and then submit it.

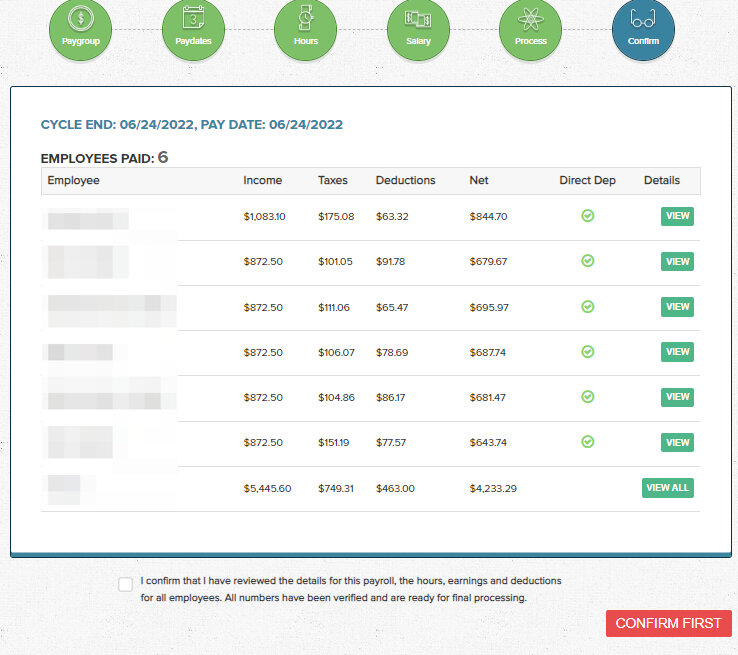

If your company has a payroll administrator who does not have authorization to process the payroll without approval, you can add a second person to authorize the payroll, once the payroll has been submitted for approval, they will get an email, and can finish the process. If not, once you confirm the payroll and check off the box, payroll can be submitted, and you’re done!

Remember all those deductions you made for CPP, EI, and taxes? Wagepoint files and remits your PD7A to the CRA, so you don’t have to.

You’ve reached the final step of the payroll process! Still with us? Let’s finish up with T4s. As you know, every employee you pay needs a T4 form.

Wagepoint will file your T4’s automatically by the due date, and your employees will be able to access them through their online account.

Chapters

2 weeks ago

You already work with remote designers and developers and manage them using cloud apps like Slack, Asana, G-Suite, Zoom, Loom, Upwork, and…

2 weeks ago

Do you need to manage recurring tasks as part of a workflow for your team? Asana is a great, free, way to do this. In this 1 min office…

Jan 23, 2025

Endless instructions and considerations make payroll services in Canada a pain. That’s why we put together this guide on how to set up…